Personal Savings Allowance 2025/24. Limits on the nil and residence. Personal savings allowance (higher rate taxpayers).

If you earn less than this, you usually won’t have to pay any income tax. Income limit for personal allowance:

If you qualify for this, as most people will, it means that you won’t pay a penny of income tax on your.

Personal Savings Allowance 202524, The £5,000 reduces by £1 for every £1 earned over £12,570 (the personal allowance). If you earn over £100,000, your personal allowance will be reduced by £1 for every £2 over the limit you earn.

What are Personal Savings Allowances? Saving Scotts, Tax rates and allowances for 2025/24 and 2025/25. Personal savings allowance (higher rate taxpayers).

Savings Accounts Personal Savings Allowance Tax Breaks, The junior isa (jisa) allowance is still £9,000. Personal savings allowance for basic rate taxpayers:

Personal Savings Allowance Explained Balance Online, Buried away within the small print of yesterday's budget, there are some promising signs for britain's savers, including a potential 2025 isa limit rise. Below we explain how to report savings income to hmrc proactively and we also reveal one of the top ways to put money aside tax free.

What is the Personal Savings Allowance YouTube, Personal savings allowance for higher rate taxpayers: £100,000 (allowance reduced by £1 for.

Understanding the new Personal Savings Allowance Money Saving Answers, Personal savings allowance for higher rate taxpayers: Below we explain how to report savings income to hmrc proactively and we also reveal one of the top ways to put money aside tax free.

Do you know how much your Personal Savings Allowance is? Adcock Financial, If you earn less than this, you usually won’t have to pay any income tax. Buried away within the small print of yesterday's budget, there are some promising signs for britain's savers, including a potential 2025 isa limit rise.

Personal Tax Allowance 2025/25 All You need to Know about Personal, Your personal allowance might be bigger if. As expected, the basic personal allowance remains frozen at £12,570 for the whole of the uk and the emergency code continues to be 1257l for the 2025/25 tax.

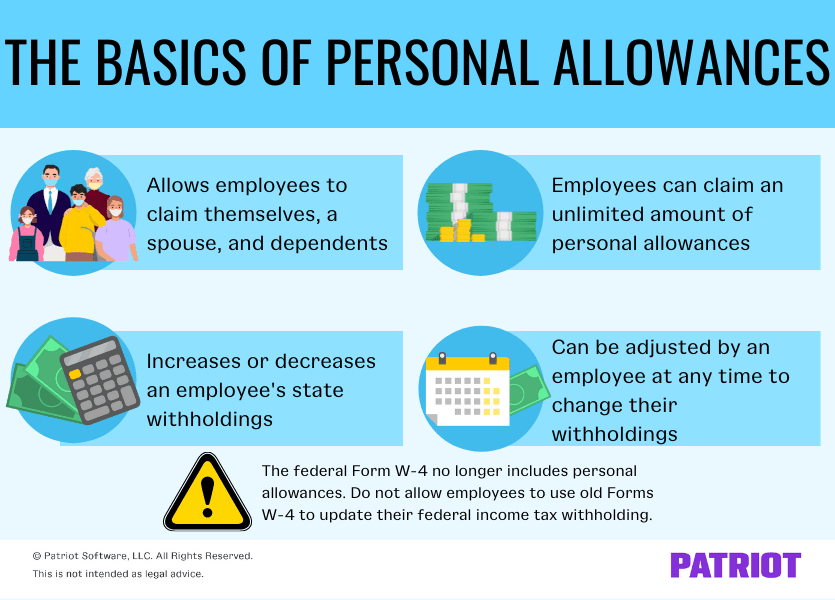

Personal Allowances What to Know About W4 Allowances, Personal savings allowance for basic rate taxpayers: It’s also worth noting that if you haven’t used your isa allowance for the 2025/24 tax year and would like to, you have until the 5 april 2025 to do so.

Personal Savings Allowance How Does It Work? UK Tax Calculators, Personal savings allowance (higher rate taxpayers). At current savings rates, you'd need to have just.